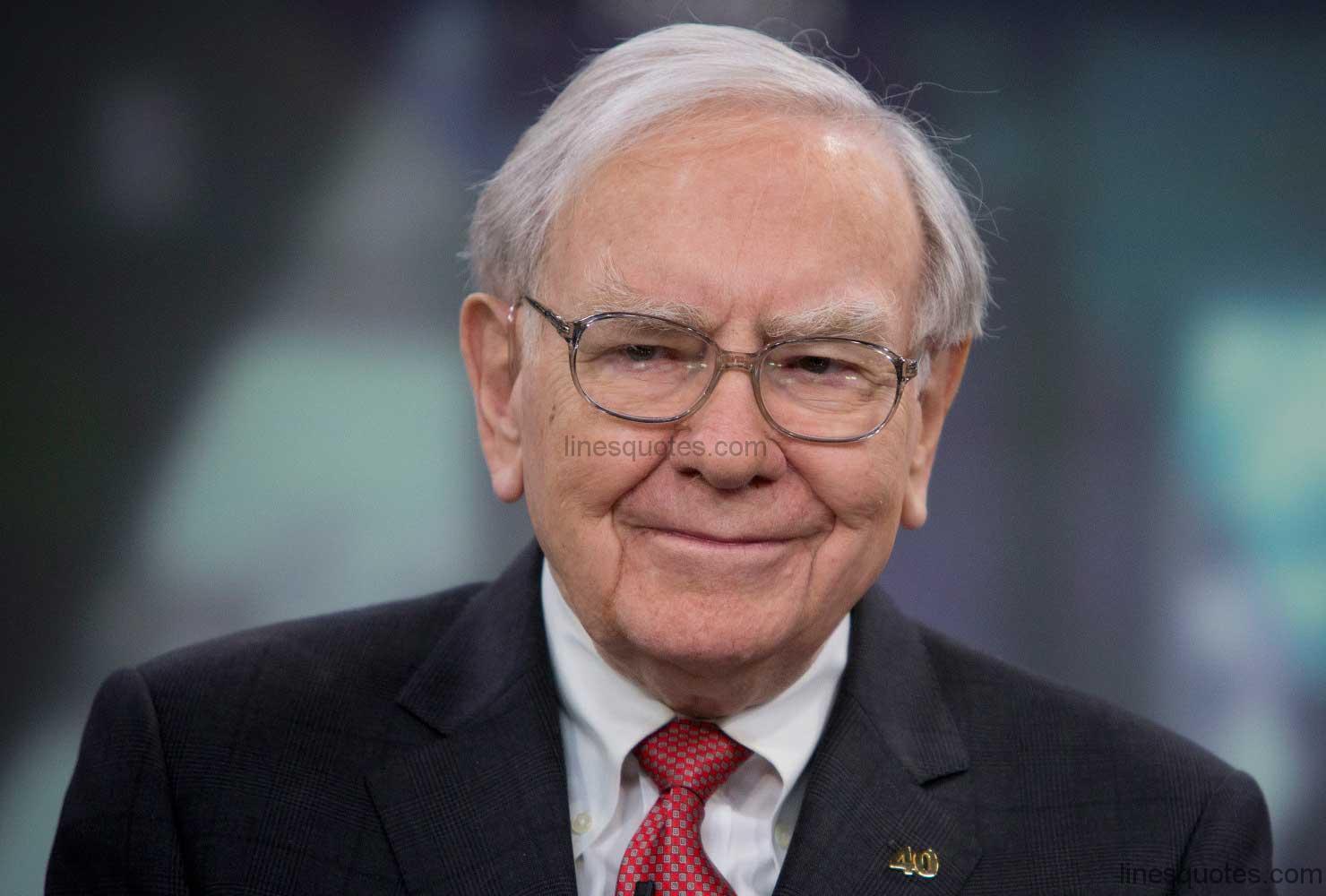

Warren Edward Buffett is an American business magnate, investor and philanthropist. He is considered by some to be one of the most successful investors in the world. Buffett is the chairman, CEO and largest shareholder of Berkshire Hathaway,and is consistently ranked among the world’s wealthiest people. He was ranked as the world’s wealthiest person in 2008 and as the second wealthiest in 2016. In 2012 Time named Buffett one of the world’s most influential people. Buffett is often referred to as the “Wizard of Omaha” or “Oracle of Omaha, or the “Sage of Omaha,” and is noted for his adherence to value investing and for his personal frugality despite his immense wealth.

It Takes 20 Years To Build A Reputation And Five Minutes To Ruin It. If You Think About That, You'll Do Things Differently.

Predicting Rain Doesn't Count. Building Arks Does.

When You Combine Ignorance And Leverage, You Get Some Pretty Interesting Results.

Time Is The Friend Of The Wonderful Company, The Enemy Of The Mediocre.

We've Used Up A Lot Of Bullets. And We Talk About Stimulus. But The Truth Is, We're Running A Federal Deficit That's 9 Percent Of Gdp. That Is Stimulative As All Get Out. It's More Stimulative Than Any Policy We've Followed Since World War Ii.

Only Buy Something That You'd Be Perfectly Happy To Hold If The Market Shut Down For 10 Years.

In The 20th Century, The United States Endured Two World Wars And Other Traumatic And Expensive Military Conflicts; The Depression; A Dozen Or So Recessions And Financial Panics; Oil Shocks; A Flu Epidemic; And The Resignation Of A Disgraced President. Yet The Dow Rose From 66 To 11,497.

The Only Way To Get Love Is To Be Lovable. It's Very Irritating If You Have A Lot Of Money. You'd Like To Think You Could Write A Check: 'I'll Buy A Million Dollars' Worth Of Love.' But It Doesn't Work That Way. The More You Give Love Away, The More You Get.

Today People Who Hold Cash Equivalents Feel Comfortable. They Shouldn't. They Have Opted For A Terrible Long-term Asset, One That Pays Virtually Nothing And Is Certain To Depreciate In Value.

Basically, When You Get To My Age, You'll Really Measure Your Success In Life By How Many Of The People You Want To Have Love You Actually Do Love You.

If Past History Was All There Was To The Game, The Richest People Would Be Librarians.

Risk Comes From Not Knowing What You're Doing.

There Seems To Be Some Perverse Human Characteristic That Likes To Make Easy Things Difficult.

I Never Attempt To Make Money On The Stock Market. I Buy On The Assumption That They Could Close The Market The Next Day And Not Reopen It For Five Years.

Rule No.1: Never Lose Money. Rule No.2: Never Forget Rule No.1.

I Don't Look To Jump Over 7-foot Bars: I Look Around For 1-foot Bars That I Can Step Over.

Look At Market Fluctuations As Your Friend Rather Than Your Enemy; Profit From Folly Rather Than Participate In It.

You Only Have To Do A Very Few Things Right In Your Life So Long As You Don't Do Too Many Things Wrong.

The Only Time To Buy These Is On A Day With No 'Y' In It.

When A Management With A Reputation For Brilliance Tackles A Business With A Reputation For Bad Economics, It Is The Reputation Of The Business That Remains Intact.

We Simply Attempt To Be Fearful When Others Are Greedy And To Be Greedy Only When Others Are Fearful.

Your Premium Brand Had Better Be Delivering Something Special, Or It's Not Going To Get The Business.

Derivatives Are Financial Weapons Of Mass Destruction.

Chains Of Habit Are Too Light To Be Felt Until They Are Too Heavy To Be Broken.

Only When The Tide Goes Out Do You Discover Who's Been Swimming Naked.

Wall Street Is The Only Place That People Ride To In A Rolls Royce To Get Advice From Those Who Take The Subway.

I Just Think That - When A Country Needs More Income And We Do, We're Only Taking In 15 Percent Of Gdp, I Mean, That - That - When A Country Needs More Income, They Should Get It From The People That Have It.

I Sent One E-mail In My Life. I Sent It To Jeff Raikes At Microsoft, And It Ended Up In Court In Minneapolis, So I Am One For One.

We Always Live In An Uncertain World. What Is Certain Is That The United States Will Go Forward Over Time.

Economic Medicine That Was Previously Meted Out By The Cupful Has Recently Been Dispensed By The Barrel. These Once Unthinkable Dosages Will Almost Certainly Bring On Unwelcome After-effects. Their Precise Nature Is Anyone's Guess, Though One Likely Consequence Is An Onslaught Of Inflation.

I Bought A Company In The Mid-'90s Called Dexter Shoe And Paid $400 Million For It. And It Went To Zero. And I Gave About $400 Million Worth Of Berkshire Stock, Which Is Probably Now Worth $400 Billion. But I've Made Lots Of Dumb Decisions. That's Part Of The Game.

I Think That Both Parties Should Declare The Debt Limit As A Political Weapon Of Mass Destruction Which Can't Be Used. I Mean, It Is Silly To Have A Country That Has 237 Years Building Up Its Reputation And Then Have People Threaten To Tear It Down Because They're Not Getting Some Other Matter.

I Buy Expensive Suits. They Just Look Cheap On Me.

In The Business World, The Rearview Mirror Is Always Clearer Than The Windshield.

I Am Quite Serious When I Say That I Do Not Believe There Are, On The Whole Earth Besides, So Many Intensified Bores As In These United States. No Man Can Form An Adequate Idea Of The Real Meaning Of The Word, Without Coming Here.

A Public-opinion Poll Is No Substitute For Thought.

Our Favorite Holding Period Is Forever.

The Investor Of Today Does Not Profit From Yesterday's Growth.

Of The Billionaires I Have Known, Money Just Brings Out The Basic Traits In Them. If They Were Jerks Before They Had Money, They Are Simply Jerks With A Billion Dollars.

You Do Things When The Opportunities Come Along. I've Had Periods In My Life When I've Had A Bundle Of Ideas Come Along, And I've Had Long Dry Spells. If I Get An Idea Next Week, I'll Do Something. If Not, I Won't Do A Damn Thing.

We Enjoy The Process Far More Than The Proceeds.

It's Far Better To Buy A Wonderful Company At A Fair Price Than A Fair Company At A Wonderful Price.

Why Not Invest Your Assets In The Companies You Really Like? As Mae West Said, 'Too Much Of A Good Thing Can Be Wonderful'.

The First Rule Is Not To Lose. The Second Rule Is Not To Forget The First Rule.

Should You Find Yourself In A Chronically Leaking Boat, Energy Devoted To Changing Vessels Is Likely To Be More Productive Than Energy Devoted To Patching Leaks.

We Believe That According The Name 'Investors' To Institutions That Trade Actively Is Like Calling Someone Who Repeatedly Engages In One-night Stands A 'Romantic.'

Beware Of Geeks Bearing Formulas.

The Rich Are Always Going To Say That, You Know, Just Give Us More Money And We'll Go Out And Spend More And Then It Will All Trickle Down To The Rest Of You. But That Has Not Worked The Last 10 Years, And I Hope The American Public Is Catching On.

If Anything, Taxes For The Lower And Middle Class And Maybe Even The Upper Middle Class Should Even Probably Be Cut Further. But I Think That People At The High End - People Like Myself - Should Be Paying A Lot More In Taxes. We Have It Better Than We've Ever Had It.

You Know, People Talk About This Being An Uncertain Time. You Know, All Time Is Uncertain. I Mean, It Was Uncertain Back In - In 2007, We Just Didn't Know It Was Uncertain. It Was - Uncertain On September 10th, 2001. It Was Uncertain On October 18th, 1987, You Just Didn't Know It.